BBC World Service correspondent in New York, prefacing his piece on plunging markets with a thumbnail of the ratings agencies scene – there are only 3 major players (Standard & Poor’s – S&P, Moody’s and Fitch) and they rate the world’s bonds and derivatives – but omitting an essential piece of information:

Listeners were not told that these same ratings agencies derive their primary, if not sole revenue stream, from the commission that they are paid by the merchant banks and governments that are issuing the bonds that they, the ratings agencies, rate.

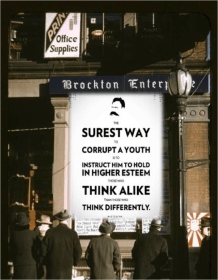

Err, herein lies an inherent contradiction – a whopping great, objective conflict of interest. In late 2010, a Eurobond dealer broke away from the conformist consensus of his peers and spoke out against the ratings agencies…

This lone voice had made it onto the BBC World Service and clearly stated that the ratings that these agencies had given toxic Greek, Spanish and Irish sovereign debt were incorrect. He ‘called’ these government bonds as sub-junk trash. He derided the ratings as being as fetid as the subprime ‘miscalculations’ of 2008 and earlier.

Good points

Many thanks, much appreciate the feedback. V b j

Great post, I think people should larn a lot from this blog its really user pleasant. So much excellent information on here :D.

thanks for your feedback & v best, j