Category: Occupy

Opinion: Bailed-out banks facilitate $21tn offshore cash hoard

July 23rd, 2012 | by Nick Mathiason | Published in All Stories, Views from the Bureau of Investigative Journalism (+ another jfreos pic)

Investigative economist James Henry exhaustively trawled through financial information held by the IMF, World Bank, Bank for International Settlements, central banks and national treasuries to come up with the most definitive report ever written on the super-rich and offshore wealth.

Henry’s Price of Offshore Revisted report, commissioned by Tax Justice Network, shows:

– between $21 trillion and $32 trillion of financial assets is owned by High Net Worth Individuals in tax havens. This does not include real estate, art or jewels.

– a conservative 3% return on that $21tn taxed at 30% would generate $189bn – a figure easily eclipsing what OECD industrialised nations spend on overseas development aid.

– the top 50 private banks collectively managed more than $12.1tn in cross-border invested assets for private clients, including their trusts. This is up from $5.4tn in 2005.

– fewer than 10 million members of the global super-rich have amassed a $21tn offshore fortune. Of these, less than 100,000 people worldwide own $9.8tn of wealth held offshore.

Accompanying the Price of Offshore Revisited is a separate paper (which I co-wrote). It reveals that data used by individual countries to assess the gap between rich and poor is inaccurate. And as a result, inequality is far more extreme than policymakers realise. This is because economists calculating inequality fail to include the vast majority of offshore cash in their findings. So the wealthy are far better off than the studies suggest.

In Inequality: you don’t know the half of it, eight of the world’s leading economists were asked whether offshore wealth was largely excluded from inequality studies. Ranging from the World Bank’s acting chief economist to academics at the Paris School of Economics and the Brookings Institute in the US, they all confirmed this was the case.

Banks and insurers are are severely under-performing when it comes to transparency, according to a report from anti-corruption NGO Transparency International.

‘Transparency in Corporate Reporting: Assessing the World’s Largest Companies’, published today, examines the policies of the 105 largest, publicly-traded companies around the world.

Companies were awarded a score between 0 and 10, with 0 being the least transparent.Financial institutions scored a very low 2.3 on Transparency International’s country-by-country reporting.

13 of the 24 financial institutions disclosed no information at all on a country-by-county basis, and six disclosed almost nothing.

Banks also scored badly on reporting on their anti-corruption policies, compared to the other industry groups:

Amongst the 24 financial institutions assessed by the NGO is UK bank Barclays. The bank, which scored 4.0 overall, has recently been at the centre of the Libor rate-fixing scandal. They are ranked 71st out of the 105 companies.

Retirees Occupy Community Center in Berlin (der spiegel)

The building was once used by the Stasi, East Germany’s dreaded secret police. But, more recently, it has served as a popular activity center for seniors in a high-rent neighborhood. When local authorities decided to shut it down and sell it, retirees adopted a classic Berlin tactic: squatting. And they’re determined to win.

The hedge fund Magnetar helped create billions of dollars’ worth of risky deals called collateralized debt obligations, many of which failed spectacularly in the financial crisis. Magnetar, meanwhile, had taken positions that allowed the firm to profit when many of those same CDOs collapsed. Since Magnetar’s dealings was reported on two years ago, there’s been a long line of investigations and settlements related to the hedge fund.

Magnetar itself has never been charged with wrongdoing, and it has always maintained that it did not have a strategy to bet against CDOs they were involved with. But today’s Wall Street Journal reported that Magnetar is indeed under investigation by the SEC.

But the Journal reports that the SEC’s investigation is looking into whether Magnetar took such a prominent role in structuring some of the CDOs in which it invested that it became a de facto collateral manager, responsible for selecting the assets in a CDO. If that were the case, Magnetar might have some responsibility to all the investors in the deal.

The SEC has been circling around the Magnetar deals for some time, hitting some of the investment banks and managers involved. Here’s a roundup of all the charges, settlements, and investigations that we know of stemming from Magnetar deals:

Settled:

June 2011: JPMorgan agrees to pay $153.6 million to the SEC to settle allegations that it misled investors by not telling them that Magnetar was involved in the creation of a CDO called Squared CDO 2007-1. In reaching the settlement, JP Morgan did not admit or deny the SEC’s allegations.February 2012: State Street Global Advisors pays the state of Massachusetts $5 million to settle allegations that it did not disclose to investors that Magnetar was involved in constructing the CDO Carina CDO Ltd. State Street did not admit or deny Massachusetts’ allegations.

Charged:

June 2011: The SEC files a complaint against manager Edward Steffelin for his involvement in structuring JPMorgan’s Squared CDO 2007. In October 2011, a judge threw out part of the SEC’s case, ruling that Steffelin had not engaged in “fraud or deceit.” Other charges are still pending. A lawyer for Steffelin declined to comment on an ongoing case.Under investigation:

June 2011: The SEC is reportedly investigating Merrill Lynch and the firm NIR Capital Management over the Magnetar CDO called Norma.September 2011: The SEC is reportedly investigating the Japanese Bank Mizuho and an executive there, Alexander Rekeda, over the making and marketing of the CDO Tigris, another Magnetar deal. Mizuho did not immediately respond to our requests for comment on the current status of the investigation.

September 2011: The SEC warns it may bring charges against the Ratings Agency Standard & Poor’s, which abruptly downgraded a Magnetar CDO called Delphinus CDO 2007-1. (In an SEC filing in February, S&P’s parent company, McGraw Hill, said that the SEC’s warnings “have no basis and they will be vigorously defended.”)

February 2012: The SEC warns Alexander Rekeda that it may bring charges against him for misleading investors about Magnetar’s role in creating Delphinus. Rekeda, who is now at the investment firm Guggenheim Capital, could not be reached today for comment.

May 2012: According to the Wall Street Journal, Magnetar itself is under investigation by the SEC. Magnetar told ProPublica in our original story that the SEC was “looking broadly” at CDOs and had requested information from Magnetar, but said that they were unaware of a particular target of the investigation.

The Journal also reports that the SEC continues to investigate NIR and its founder, Corey Ribotsky, for its role in creating Norma with Merrill Lynch. NIR did not respond to our requests for comment, but a lawyer for NIR and Ribotsky told the Journal that the firm had not acted improperly in selecting Norma’s assets. A spokesman for Bank of America, which now owns Merrill Lynch, declined to comment.

This article was by ProPublica.

Australian banks have once again failed to reduce their rates in line with the rate reduction by the Federal Reserve Bank. They are now hitting the media blaming the government and making excuses for their profit gouging. Meanwhile the gap between the rate the banks charge us to borrow and what they pay for money continues to grow and has become a permanent feature of Australian banking.

The issue is, is this fair and if not, what can we or the Government do about it?

The big banks claim that due to the Global Financial Crisis, a shortage of money to borrow has pushed up the prices they pay for their borrowings. If this is correct it is indeed a problem largely of the Banking industries making. The GFC was bought about by huge investment in sub-prime mortgages, the highly unethical bundling of sub-prime debts and shonky derivative trading by large banks and traders, mainly to pass off their bad debts to others.

In Australia any possibility of the failure of our major banks was averted by swift action from the Rudd Government which included the backing of the major banks solvency with a government guarantee. Because the Australian Government had a Triple A credit rating this enabled the banks to access funds more easily and at a cheaper rate than most overseas banks.It also gave the big four banks an advantage over smaller banks and credit unions.

Despite this advantage the building societies and credit unions have still been able to provide cheaper mortgage rates than the big four. Clearly this would indicate that the banks are pushing for greater profits and/or are less efficient than the credit unions. No doubt there is a great disparity in the salary packages as well.

The banks have already forgotten their role in the GFC and that excessive greed was their motivation. So what can be done to bring the Big Four into line? The reserve bank and its interest rate setting is independent of government. It is also unlikely that the reserve bank could give cheaper rates to credit unions and building societies due to it being anti-competitive. (Although the current system gives a financial advantage to the Big Four)

But there is an answer. The federal government is not obliged to provide a solvency guarantee to the Big Four. They could refuse to give the guarantee to banks that refuse to reasonably follow the lead of the Reserve Bank with interest reductions. The guarantee could be reinstated if they provide the Reserve with documentation showing reasonable cause for maintaining high interest rate charges to its customers. Perhaps the government guarantee should be given to approved building societies and credit unions to give them the same advantages as the big banks and this would create competitive pressure for rate reductions.

Finally you can help bring change by moving your business to cheaper institutions and banks.

The InterpretOr has found this site to check out the best rates. http://www.canstar.com.au/interest-rate-comparison/compare-home-loan-rates.html

“We are economists who oppose ideological cleansing in the economics profession. Equally we oppose political cleansing in the vital debate over the causes and consequences of our current economic crisis.

We support the efforts of the Occupy Wall Street movement across the country and across the globe to liberate the economy from the short-term greed of the rich and powerful one percent.

We oppose cynical and perverse attempts to misuse our police officers and public servants to expel advocates of the public good from our public spaces.

We extend our support to the vision of building an economy that works for the people, for the planet, and for the future, and we declare our solidarity with the Occupiers who are exercising our democratic right to demand economic and social justice.”

Gerald Epstein / University of Massachusetts Amherst

James K. Boyce / University of Massachusetts Amherst

Taro Abe / Nagoya Gakuin University

Fikret Adaman / Bogazici University

Bengi Akbulut / University of Manchester

Randy Albelda / University of Massachusetts Boston

Michael Albert / Z Communications

Sylvia A. Allegretto / University of California Berkeley

Gar Alperovitz / University of Maryland

Jack Amariglio / Merrimack College

Nurul Aman / University of Massachusetts Boston

Miguel Arce / Universidad del Valle

Michael Ash / University of Massachusetts Amherst

Enid Arvidson / University of Texas at Arlington

Dennis Badeen / York University

Lee Badgett / University of Massachusetts Amherst

Ron Baiman / Center for Tax and Budget Accountability

Dean Baker / Center for Economic and Policy Research

Samuel L. Baker / Purdue University

Scott Baker / Public Banking Institute

Erdogan Bakir / Bucknell University

Benjamin Balak / Rollins College

Radhika Balakrishnan / Rutgers University

Fabian Balardini / Borough of Manhattan Community College

Nesecan Balkan / Hamilton College

Ahmet Baytas / Montclair State University

Nina Banks / Bucknell University

Sundari Baru

Deepankar Basu / University of Massachusetts Amherst

Michael Beggs / University of Sydney

José Bellver/ Complutense University of Madrid

Suzanne Bergeron / University of Michigan Dearborn

Ravi Bhandari / St. Mary’s College

Marc Bilodeau / Indiana University – Purdue University Indianapolis

Cyrus Bina / University of Minnesota

Peter C. Bloch / University of Wisconsin-Madison

Raford Boddy / San Diego State University

Roger Evan Bove / West ChesterUniversity

Elissa Braunstein / Colorado State University

Garth A. Brazelton / Indiana Economic Development Corporation

Neil Brenner / Harvard University

Ted Burczak /Denison University

Antonio Callari / Franklin and Marshall College

Isabela Prado Callegari – São Paulo School of Economics

Duncan Cameron / Canadian Centre for Policy Alternatives

Al Campbell / University of Utah

Gerald Campbell / University of Wisconsin Madison

Martha Campbell / Potsdam College (SUNY)

Emanuele Campiglio / New Economics Foundation

Juan Camilo Cardenas / Universidad de Los Andes

Bruce E. Carpenter / Mansfield University

Jessica Carrick-Hagenbarth / University of Massachusetts Amherst

Scott Carter / University of Tulsa

Hugo E. A. da Gama Cerqueira / Universidade Federal de Minas Gerais

Paresh Chattopadhyay / University of Quebec

Robert Chernomas / University of Manitoba

Savvina Chowdhury / Evergreen State College

Jens Christiansen / Mount Holyoke College

Kimberly Christensen / Sarah Lawrence College

Alan B. Cibils / Universidad Nacional de General Sarmiento

Jennifer Cohen / University of Massachusetts Amherst

Steve Cohn / Knox College

Alessio Conti / University of Rome

Paul Cooney / Universidade Federal do Pará

Evelyn B. Córdova / La Universidad del Zulia

James V. Cornehls

Lilia Costabile / University of Naples

J. Kevin Crocker / University of Massachusetts Amherst

James Crotty / University of Massachusetts Amherst

James M. Cypher / Universidad Autónoma de Zacatecas

Omar S. Dahi / Hampshire College

Anita Dancs / Western New England University

Adel Daoud / University of Gothenburg

Leila Davis / UMass Amherst

Erik Dean / University of Missouri Kansas City

Carmen Diana Deere / University of Florida

Chase DeHan / University of Utah

Francois Delorme / Association des Economistes Québécois

Joao Paulo de Souza / University of Massachusetts Amherst

George DeMartino / University of Denver

Serkan Demirkilic / University of Massachusetts Amherst

Maarten de Kadt

Hans Despain / Nichols College

Carlo D’Ippoliti / Sapienza University of Rome

Jonathan Diskin / Earlham College

Geert Dhondt / City University of New York

David Donald / Glasgow Caledonian University

Peter Dorman / Evergreen State College

P.K. Dollar / PI Marketing Research

Laura Dresser / Center on Wisconsin Strategy

Mathieu Dufour / City University of New York

Lynn Duggan / Indiana University Bloomington

Anil Duman / Central European University

Amitava Krishna Dutt / University of Notre Dame

Gary Dymski / University of California Riverside

Marie Christine Duggan / Keene State College

Nina Eichacker / University of Massachusetts Amherst

David Ellerman / University of California at Riverside

Benan Eres / Ankara University

Bilge Erten / United Nations, DESA

Paula Esteves / Federal University of Minas Gerais

Joshua Farley / University of Vermont

Ramon Garcia Fernandez / Universidade Federal do ABC

Antonio J. Fernos-Sagebien / Universidad Interamericana de Puerto Rico

Kade Finnoff / University of Massachusetts Boston

Nancy Folbre / University of Massachusetts Amherst

Michael Fortunato / Williams College

Robert Francis / Shoreline Community College

L. Carlos Freire-Gibb / Aalborg University

Gerald Friedman / University of Massachusetts Amherst

James K. Galbraith / University of Texas Austin

Robert F. Garnett / Texas Christian University

Heidi Garrett-Peltier / University of Massachusetts Amherst

David George / La Salle University

Armagan Gezici / Keene State College

Norman Glickman / Rutgers University

David Gold / The New School

William W. Goldsmith / Cornell University

Don Goldstein / Allegheny College

Jonathan P. Goldstein / Bowdoin College

Christian Gormsen / Centre d’Economie de la Sorbonne

Mitch Green / University of Missouri Kansas City

Robin Hahnel / American University

Jane V. Hall / California State University Fullerton

Jay P. Hamilton / City University of New York

Amy Hart / University of Sydney

Martin Hart-Landsberg / Lewis and Clark College

James Heintz / University of Massachusetts Amherst

John F. Henry / University of Missouri Kansas City

Doug Henwood / Left Business Observer

Arturo Hermann / ISTAT

Ivan-Dario Hernandez-Umaña / Universidad Nacional de Colombia

Conrad M. Herold / Hofstra University

Marianne Hill / Mississippi Center for Policy Research

Rod Hill / University of New Brunswick

Michael G. Hillard / University of Southern Maine

Larry Hochendoner / World Health Care Infrastructures

Wolfgang Hoeschele / Truman State University

Joan Hoffman / City University of New York

Sue Holmberg / University of Massachusetts Amherst

Kiaran Honderich / Williams College

Jong Haak Hong / Kyungwon University

Barbara Hopkins / Wright State University

Julio Huato / St. Francis College

Alan Hutton / Glasgow Caledonian University

Prue Hyman / Victoria University of Wellington (ret.)

John Ikerd / University of Missouri

Ruth Indeck / Economy Connection

Ryan Isakson / University of Toronto

Jean Jacobson / University of Minnesota Duluth

Frederic B. Jennings Jr. / Center for Ecological Economics and Ethical Education, Ipswich, MA

Tae-Hee Jo / Buffalo State College

Calanit Kamala / UC Berkeley

Emily Kawano / University of Massachusetts Amherst

Seçil Aysed Kaya / Ankara University

Serap A. Kayatekin / American College of Thessaloniki

Steve Keen / University of Western Sydney

Mehmet Rauf Kesici / Kocaeli University

Marlene Kim / University of Massachusetts Boston

Yun Kyu Kim / Trinity College

Mary C. King / Portland State University

Stephen Kinsella / University of Limerick

Robert Kirsch / Virginia Tech

Gerda Kits / The King’s University College

Mark Klinedinst / University of Southern Mississippi

Tim Koechlin / Vassar College

Charles Komanoff / Carbon Tax Center

Charalampos Konstantinidis / University of Massachusetts Amherst

Katharine Kontak / Bowling Green State University

Gonca Konyali / Dokuz Eylul University

David Kotz / University of Massachusetts Amherst

Philip Kozel / Rollins College

David Kristjanson-Gural / Bucknell University

David Laibman / City University of New York

Eric Larsen / Public Policy Institute of California

Mehrene Larudee / Al-Quds Bard Honors College

Michael A. Lebowitz / Simon Fraser University

Chai-On Lee / Chonnam National University

Frederic Lee / University of Missouri Kansas City

Fernando Leiva / University at Albany (SUNY)

Gianmarco Leon / UC Berkeley

Charles Levenstein / University of Massachusetts Lowell

Margaret Levenstein / University of Michigan

Gerald Levy / LaGuardia Community College (CUNY)

Richard Lichty / University of Minnesota Duluth

Patricia J. Lindsey

Antonio Lopes / Second University of Naples

Sean MacDonald / City University of New York

Arthur MacEwan / University of Massachusetts Boston

Fiona Maclachlan / Manhattan College

Brian K. MacLean / Laurentian University

Allan MacNeill / Webster University

Claudio Fernández Macor / Universidad Nacional del Litoral

Yahya M. Madra / Boğaziçi University

Rasigan Maharajh / Tshwane University of Technology

Eric Malm / Cabrini College

Carlos Marentes / University of Massachusetts Amherst

Stephen A Marglin / Harvard University

John E. Peters / Marist College

Wesley Marshall / UAM-Iztapalapa

Stephanie Martin / Allegheny College

Thomas Masterson / Levy Economics Institute of Bard College

Julie Matthaei / Wellesley College

Peter Hans Matthews / Middlebury College

Matthew May / University of Missouri Kansas City

Elaine McCrate / University of Vermont

H. Neal McKenzie

Andrew Mearman / University of the West of England, Bristol

Matthieu Meaulle / Foundation for European Progressive Studies

Michael Meeropol / Western New England University

Ralph Meima / Marlboro College Graduate School

César Viteri Mejía / University of Massachusetts Amherst

John D. Messier / University of Maine Farmington

Peter B. Meyer / University of Louisville

James Miehls / University of Massachusetts Amherst

John A. Miller / Wheaton College

Rob Moir / University of New Brunswick

Gary Mongiovi / St. John’s University

Fred Moseley / Mount Holyoke College

Albert Mosley / Smith College

Tracy Mott / University of Denver

Jamee K. Moudud / Sarah Lawrence College

Adil Mouhammed / University of Illinois at Springfield

Catherine P. Mulder / City University of New York

Marta Murray-Close / University of Massachusetts Amherst

Ellen Mutari / The Richard Stockton College of New Jersey

Sirisha Naidu / Wright State University

Michele Naples / The College of New Jersey

Kamran Nayeri / University of California Berkeley

Jessica Gordon Nembhard / City University of New York

Julie A. Nelson / University of Massachusetts Boston

Emil Nieves-Mounier / Government Development Bank of Puerto Rico

Eric Nilsson / California State University San Bernardino

Richard B. Norgaard / University of California Berkeley

Jennifer Olmsted / Drew University

Erik Olsen / University of Missouri Kansas City

Ozlem Onaran / University of Westminster

Hiroshi Onishi / Kyoto University

Miguel Otero-Iglesias / ESSCA – School of Management

Cem Oyvat / University of Massachusetts Amherst

Aaron Pacitti / Siena College

Thomas Palley / New America Foundation

Susan Parks / University of Wisconsin-Whitewater

Eva Paus / Mount Holyoke College

Samuel R Pavel / Southern Illinois University Carbondale

Karl Petrick / Western New England University

Nicolas Pons-Vignon / University of the Witwatersrand

Manisha Pradhananga / University of Massachusetts Amherst

Robert E. Prasch / Middlebury College

Paddy Quick / St. Francis College

Peter Radford

Elizabeth A. Ramey / Hobart and William Smith Colleges

Wendy Rayack / Wesleyan University

Arslan Razmi / University of Massachusetts Amherst

Jack Reardon / Hamline University

Angelo Reati

Joseph Rebello / University of Massachusetts Amherst

Sanjay G. Reddy / The New School for Social Research

Robert Reinauer / Rollins College

Stephen Resnick / University of Massachusetts Amherst

Cecilia Rio / Towson University

Meenakshi Rishi / Seattle University

Judith Robinson / Castleton State College

Igor Lopes Rocha / University of Cambridge

John Roche / St. John Fisher College

Charles P. Rock / Rollins College

Leopoldo Rodriguez / Portland State University

Frank Roosevelt / Sarah Lawrence College

Luis D. Rosero / Fitchburg State University

Sergio Rossi / University of Fribourg

David F. Ruccio / University of Notre Dame

Héctor Sáez / University of Massachusetts Amherst

Blair Sandler / University of Massachusetts Amherst

John Sarich / Cooper Union for the Advancement of Science and Art

Daniel E. Saros / Valparaiso University

Harwood D. Schaffer / University of Tennessee Institute of Agriculture

Helen Scharber / Hampshire College

Ted P. Schmidt / Buffalo State College

John Schmitt / Center for Economic and Policy Research

Alyssa Schneebaum / University of Massachusetts Amherst

Markus P. A. Schneider / University of Denver

Juliet Schor / Boston College

Eric A. Schutz / Rollins College

Elliott Sclar / Columbia University

Mario Seccareccia / University of Ottawa

Ian J. Seda-Irizarry / University of Massachusetts Amherst

Kristen Sheeran / Economics for Equity and the Environment

Barry Shelley / Brandeis University

Laurence Shute / California State Polytechnic University Pomona

Elizabeth Sloan / University of Utah

Ceren Soylu / University of Massachusetts Amherst

Peter Spiegler / University of Massachusetts Boston

Janet Spitz / The College of Saint Rose

Jim Stanford / Canadian Auto Workers

Liz Stanton / Tufts University

Martha A. Starr / American University

Howard Stein / University of Michigan

Mark Stelzner / University of Massachusetts Amherst

Tamara Stenn / Keene State College

John Stifler / University of Massachusetts Amherst

Engelbert Stockhammer / Kingston University

Ian C. Strachan / Nichols College

Sarah Surak / Virginia Tech

Behrouz Tabrizi / St. Francis College

Janet M. Tanski / University of Missouri

Linwood Tauheed / University of Missouri Kansas City

Kenna Taylor / Rollins College

Pavlina R. Tcherneva / Franklin and Marshall College

Hasan Tekgüç / Mardin Artuklu University

Frank Thompson / University of Michigan

Jim Tober / Marlboro College

Zdravka Todorova / Wright State University

Junji Tokunaga / University of Massachusetts Amherst

Mariano Torras / Adelphi University

Mayo Toruño / California State University San Bernardino

Andrew Trigg / Open University

A. Dale Tussing / Syracuse University

Eric Tymoigne / Lewis and Clark College

Salimah Valiani / Ontario Nurses’ Association

Hendrik Van den Berg / University of Nebraska – Lincoln

Marjolein Van Der Veen

Nick Velluzzi / Walla Walla Community College

Roberto Veneziani / Queen Mary University of London

Matías Vernengo / University of Utah

Valerie Voorheis / University of Massachusetts Amherst

Mwangi wa Gĩthĩnji / University of Massachusetts Amherst

Daniel G. Weaver / Rutgers University

Thomas E. Weisskopf / University of Michigan

Julian Wells / Kingston University

Scott A. Weir / Wake Technical Community College

Anastasia C. Wilson / University of Massachusetts Amherst

Maggie Winslow / Presidio Graduate School

Marty Wolfson / University of Notre Dame

L. Randall Wray / University of Missouri Kansas City

Yavuz Yaşar / University of Denver

Michael D. Yates / University of Pittsburgh at Johnstown

Jong-Il You / KDI School of Public Policy and Management

Ajit Zacharias / Bard College

Jeffrey Zink / Morningside College

Barbara Zoloth

Klara Zwickl / University of Massachusetts Amherst

Apple is cheating and ripping off Australian consumers. Apple launched its new iPad in Australia saying it was compatible with the Telstra 4G network but consumers found that it used the wrong frequency. Apple is offering refunds to buyers who were mislead.

While this could have been an oversight because it is compatible with other Australian 4G networks, its overcharging of Australian consumers is a deliberate rip off.

In Australia the prices for the new iPad is A$539.00 or in US dollars $562.00 while US consumers pay just US $499.00. The iPad 2 is $447.00 in Australia and $399.00 in the US. Given that the iPads are made in China, the freight cost should be pretty much the same. Apple will not allow anyone from Australian postcodes to buy from its US store to bypass this price differential.

So when you buy your iPad in Oz just think of those poor Americans you are subsidizing. Just like Australian taxpayers helping to pay to support the US Government oil wars in the Middle East they have come to expect it of us.

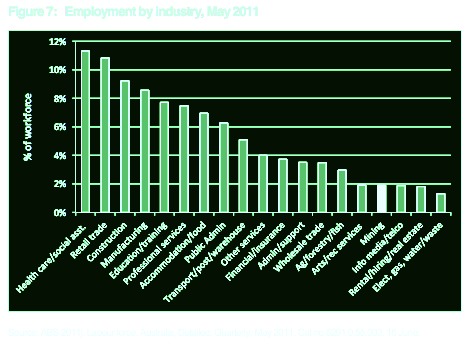

This graph is derived from Australian Bureau of Statistics, ‘Labour force Australia’, 2011.

Imagined employment levels in the mining sector, as conveyed by ongoing cheesy ‘Our Story’ mining lobby adverts, give the impression that the sector employs so many millions of Australians that we should all quit the day job and go FIFO…

An executive at Goldman Sachs left the firm 14 March ’12 with a bang, penning a New York Times op-ed accusing the company of increasingly putting profits ahead of clients. Greg Smith started as an intern 12 years ago and last headed a derivatives department. Not surprisingly, Goldman quickly and strongly disagreed with his take.

There have obviously been plenty of unflattering headlines about Goldman in the past few years. We decided to look at just one aspect of their record: US Securities and Exchange Commission (SEC) charges levied against Goldman and its employees over the past decade.

April 2003: SEC charges Goldman Sachs over conflicts of interest among its research analysts. The company eventually settled for $110 million in fines and disgorgements.

November 2003: Former Goldman economist John Youngdahl pleads guilty to insider trading. The firm had to pay the SEC $4.2 million over profits it gained from the illegal dealings.

July 2004: Goldman settles with the SEC for $10 million over charges it improperly promoted a stock sale involving PetroChina.

January 2005: Goldman settles with the SEC for $40 million over charges that it violated securities law in promoting initial public offerings.

April 2006: Two former Goldman employees are charged with running an international insider-trading ring while they were at the firm. Eugene Plotkin and David Pajcin, both in their 20s, paid off insiders at other firms and stole early copies of Business Week to get an edge. They also tried (unsuccessfully) to use strippers to get information. Both eventually served jail time.

March 2007: A Goldman subsidiary, Goldman Execution and Clearing, settles with the SEC for $2 million over allegations that faulty oversight that allowed customers to make illegal trades.

March 2009: Goldman Execution and Clearing settles with the SEC for $1.2 million over improper proprietary trading by employees.

July 2009: The SEC charges a former Goldman Sachs trader Anthony Perez and his brother with insider trading based on information Anthony Perez obtained through his job at Goldman Sachs. He was fined $25,000 and his brother more than $150,000.

May 2010: The SEC hits Goldman Execution and Clearing with a $225,000 fine for violating a rule aimed at regulating short selling.

July 2010: Goldman settles with the SEC for $553 million over allegations that it misled investors about the collateralized debt obligation ABACUS 2007-AC1 by not disclosing the involvement of a hedge fund in its creation, or the fact that the hedge fund stood to benefit if the CDO failed. Goldman executive Fabrice Tourre was also charged.

March 2011: The SEC charges Goldman board member Rajat Gupta with insider trading. Gupta allegedly passed on information he learned as a board member to the hedge fund Galleon Group. In October, 2011, he was arrested and hit with criminal charges by the FBI. The case is pending.

September 2011: The SEC charges a Goldman employee, Spencer Midlin, and his father for insider trading based on information Spencer Midlin gained from his position at Goldman Sachs. The two men were ordered to pay $92,000.

February 2012: Goldman Sachs receives notice from the SEC that the agency may bring charges related to mortgage backed-securities.

This article was taken from ProPublica.

They kept on and on about shopping. ‘The shops’ this. The shops that.

How did that make you feel?

Annoyed. I was getting really fed up with it all. I had this idea that my life would be different…That there was much more to being in this world than the shops. I mean, they’re shops. That’s all!

You feel that there’s more to life?

Of course their bloody well is. Infinitely more – texture, nuance, connection, love…

If we can recap a little on last week, you made mention of ‘the markets’…

Yes, I did, I remember I did…

Were these markets important to you, special in some way?

It’s ironic, really, because the word means many different things. When I was young and in my early 20’s in London, the markets meant Portobello Road on non-touristy weekdays and all the colours, smells, people, vibes…

And the irony? What was ironic about the markets?

Again, there was plenty that was ironic about Portobello, but in a warm, eclectic, slightly good crazy way. Even more ironic that the phrase ‘the markets’ took on a totally different meaning – towards the end of the news on tv they’d talk of having a “quick look at the markets” and then cite all these codes and meaningless figures.

So, ‘the markets’ changed or evolved a different meaning for you?

Yes, yes. Very different. Polar opposites. From cheap daffodils punctuating cloudy afternoons to manic energy and frantic, unhappy men in offices…

Clean the $100 notes and marinate in oil. Cut a few slashes in the $20 bills…

Combine lemon juice, 2 cloves of garlic and chives…

Preheat a frying pan or barbecue plate…

Cook the notes for 20-30 seconds each side.

Serve with salad or greens or thin fried potatoes.

Bon appetit!

And the KPMG report estimates the costs of businesses’ environmental impacts are doubling every 14 years.

more at abc’s the Drum

Only After the last tree has been cut down,

Only after the last river has been poisoned,

Only after the last fish has been caught,

Only then will you find that

money cannot be eaten.

Native American proverb.

i’m a regular fair dinkum guy and ma name’s andy…what “heritage”…Sir John Forrest…who’z eee???

andy’s fair dinkum Wikipedia entry includes…

great-great nephew of John Forrest, the first premier of Western Australia.

whats all that “hereditary” claptrap, stuff und nonsense? it’s all right for Roopert M and Jimmy P, so why not me, fair dinkum andy?

There’s no “principle” in the hereditary principle!

Don’t be silly, Keith. Of course there is…

No there’s not. I think it’s a load of rubbish.

Why, why, you’re too young to really understand, aren’t you. Peter, Peter, isn’t he. Isn’t Keith being silly?

Hmmph, yes dear. Look Keith, there are some very decent people in the royal family!

How do you know? Have you ever met any of them?

Hmmmph, yes, as a matter of fact, I have.

Yes, yes. Peter actually met Princess Anne…

So what?

Hmmph, now look here, young fella. Princess Anne sometime late summer and she was actually terribly nice.

They are parasites and why do you think it is good that other people are just born into power and then ride around on their fat bums?

Ohh, silly boy. You just don’t understand, do you? You think you do, but you do not. They are good people doing a difficult job….

Hmmmph, yes, yes, listen to your mother, Keith. You sound like a spoilt brat.

I’m not and I think they’re a bunch of bloody parasites!

35 years on and I believe as strongly as ever that there is no principle in the hereditary principle.

The sentence above serves as an indictment of the further and intensive financial deregulation that characterised the Bush/Cheney years.In Australia, the Abbott Junta phurphy of business can do no wrong is punctured by the reality check of the US experience for ordinary Americans:

“It bears repeating one last time that average compensation (wages) never grew as slowly in American industrial history than it did over the course of the age of greed.”

Jeff Madrick (Roosevelt Insitute Snr Fellow and NY Times contributor) Age of Greed, Random House, 20011

In reality, as worker productivity rose, the ensuing gains went to…CORPORATE PROFITS.

“…blind to the national interest, and who pour their considerable personal fortunes into advertising, armies of lobbyists, dodgy modelling and corporate and commercial manoeuvring…”

Wayne Swan describing certain Oz billionaires in March’s the mOnthly.

The article in full @ http://www.themonthly.com.au/rising-influence-vested-interests-australia-001-cent-wayne-swan-4670

British entrepreneur and Virgin space cadet, Richard Branson, has this to say about Occupy:

“I think it’s an admirable movement, it’s a peaceful movement. The only thing that’s not been peaceful is the way the police in some states have dealt with it, which I think is absolutely wrong.”

More at the New Yorker – see our blogroll for link.

Locked Up Alone is the report of Human Rights Watch into Detention Conditions and Mental Health at Guantanamo

This 54-page report documents the conditions in the various “camps” at the detention center, in which:

- approximately 185 of the 270 detainees are housed in facilities akin to “supermax” prisons even though they have not yet been convicted of a crime.

- These detainees have extremely limited contact with other human beings, spend 22 hours a day alone in small cells with little or no natural light or fresh air, are not provided any educational opportunities, and are given little more than a single book and the Koran to occupy their time.

- Even their two hours of “recreation” time – which is sometimes provided in the middle of the night – generally takes place in single-cell cages so that detainees cannot physically interact with one another.

The absence of social and environmental stimulation has been found to lead to a range of mental health problems, ranging from:

- insomnia and confusion to hallucinations and psychosis.[44]

- Stuart Grassian, a psychiatrist specializing in conditions of confinement who has evaluated hundreds of inmates in different prisons, warns that even inmates with no prior history of mental illness can become “significantly ill” when subjected to prolonged periods of isolation.[45]

On January 11, 2002, the United States brought the first 20 prisoners to the Guantanamo Bay detention facility, marking the beginning of a program of indefinite detention without charge or trial of terrorism suspects that has lasted 10 years. Since then, a total of 779 prisoners have been held at the facility…Human Rights Watch, more at http://www.hrw.org/node/104102

Instead of focusing on increasing economic growth, shouldn’t the focus be on long-term sustainability and durability?

This is the question raised and addressed by Kenneth Rogoff, Professor of Economics and Public Policy at Harvard University, formerly chief economist at the IMF:

Cambridge, United Kingdom – ‘Modern macroeconomics often seems to treat rapid and stable economic growth as the be-all and end-all of policy. That message is echoed in political debates, central-bank boardrooms and front-page headlines. But does it really make sense to take growth as the main social objective in perpetuity, as economics textbooks implicitly assume?

Certainly, many critiques of standard economic statistics have argued for broader measures of national welfare, such as life expectancy at birth, literacy, etc. Such appraisals include the United Nations Human Development Report, and, more recently, the French-sponsored Commission on the Measurement of Economic Performance and Social Progress, led by the economists Joseph Stiglitz, Amartya Sen and Jean-Paul Fitoussi…

…There is a certain absurdity to the obsession with maximising long-term average income growth in perpetuity, to the neglect of other risks and considerations.’

more @ http://www.aljazeera.com/indepth/opinion/2012/01/20121312591520271.html

‘He signed it. We’ll fight it.’

President Obama opened 2012 by signing the National Defense Authorization Act (NDAA) into law. ACLU are concerned that “it contains a sweeping worldwide indefinite detention provision.”

“The dangerous new law can be used by this and future presidents to militarily detain people captured far from any battlefield. He signed it. Now, we have to fight it wherever we can and for as long as it takes. Sign the ACLU’s pledge to fight worldwide indefinite detention for as long as it takes.” (ACLU)

The interpretOr would add that these concerns are legitimate and we only have to recall the practice of ‘Extraordinary Rendition’ that was a hallmark of the Bush/Cheney presidential era. Habeas Corpus denied again? What of the protections afforded by the Geneva Conventions?

That such sweeping legislation is enacted over a traditional ‘slow news’ holiday period further diminishes any semblance of honouring the public interest.

more @ https://secure.aclu.org/site/SPageServera=JServSessionIdr004&s_subsrc=120103_NDAA_mar&pagename=120103_NDAAGOLAsk

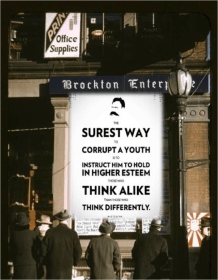

Looking at intrinsic and extrinsic values & motivation seems timely…

EXTRINSIC VALUES:

CONFORMITY, TO ‘FIT IN’ WITH OTHER PEOPLE.

IMAGE, TO LOOK ATTRACTIVE TO OTHER PEOPLE IN TERMS OF BODY AND CLOTHING.

FINANCIAL SUCCESS. TO BE WEALTHY AND MATERIALLY SUCCESSFUL RELATIVE TO OTHERS.ACHIEVEMENT. PERSONAL SUCCESS THROUGH DEMONSTRATING COMPETENCE ACCORDING TO SOCIAL STANDARDS.POWER SOCIAL STATUS AND PRESTIGE, CONTROL OR DOMINANCE

INTRINSIC VALUES:

AFFILIATION, TO HAVE SATISFYING RELATIONSHIPS WITH FAMILY AND FRIENDS. SELF-ACCEPTANCE . TO FEEL COMPETENT AND AUTONOMOUS. COMMUNITY FEELING, PRESERVING AND ENHANCING THE WELFARE OF THOSE WITH WHOM ONE IS IN FREQUENT PERSONAL CONTACT (THE ‘IN-GROUP’). UNIVERSALISM, UNDERSTANDING, APPRECIATION, TOLERANCE, AND PROTECTION FOR THE WELFARE OF ALL PEOPLE AND FOR NATURE.

More @ http://www.pirc.info

The Public Interest Research Council is an independent charity integrating key research on climate change, energy & economics – widening its audience and increasing its impact. Examination of the intrinsic/extrinsic paradigm is an important element of their recent paper, Think Of Me As Evil :

“Despite its alarmist title, this is a careful evaluation of the costs and benefits of advertising. It makes a good case, on economic, social, and cultural grounds, for respite from the all-pervasive advocacy of consumerism.”

Avner Offer, Chichele Professor of Economic History, All Souls College, Oxford, and author of The Challenge of Affluence

The links between the stunning Arab uprising and the uprising of disaffected citizens in the United States of America have been noted by many observers. However it would be a mistake to say they are the same. There are major differences that should be noted and considered in dealing with the societal problems each movement is highlighting.

The seasons of the year have provided apt names for each uprising – there is an ironic resonance of the names with the condition and state of democratic system of each country. While the Arab Spring uprising is a nascent growth of a new democracy, the Americans and other Western versions are an expression of the Autumnal decay of Western democracies.

The Arab Spring has been enabled by the widespread use of information technology that has imparted the knowledge that a better, freer life has been possible in the democratic West. Having seen the vision through the lens of the worldwide web, an enthusiastic and irreversible momentum has emerged that renders tanks and missiles impotent, even ridiculous to the enthusiasm and determination of the masses.

The movement in the US has gained energy from the courage and single-minded determination of the heroic peoples of the Middle East who have stood firm in the face of brutality. However, that joyous spirit is not part of the Western uprising because it has caused the people in the US to look back and see that their democratic egalitarian vision has been hijacked and all but destroyed by the corporate takeover of their governments. Successive politicians have accepted the handful of silver and sold their future.

The truth is America is no longer an egalitarian society either in spirit or in reality. While the first non-white president occupies the Whitehouse, no poor man, no matter how brilliant a thinker has a chance to take his place, unless he or she is sponsored by corporations.

Laws are now being propagated by corporations through organisations like ALEC (The American Legislative Executive Committee). Behind closed doors corporations and right wing politicians are creating model laws and regulations. These laws are not written for the wellbeing of Joe or Jane Citizen. With the help of politicians, corporations like Phillip Morris and Monsanto and Exxon are able to reduce health, safety and environmental laws protecting the public and private education companies are able to erode state funding of education. These are dangerous times in the home of democracy.

Further undermining democracy are the major media networks funded by the money from the same corporations. These greedy pipers have forsaken the music for mammon. We no longer get news and an exchange of ideas from the press or even a balanced critique of government. Instead we get thinly veiled propaganda and outright lies for profit as is now being exposed by the media inquiry in the United Kingdom.

Media moguls are obsessed with being kingmakers rather than being providers of knowledge and information. Their primary fare is a mixture of misinformation, heavily biased opinion pieces, deliberately leaving out important information that underpin political decisions, using out of context statements; character assassination by innuendo and using terms like “unidentified party sources say”, where there is no proof. More recently the media has hacked phones paid police and other officials for dirt on their victims.

These spin masters are also spying on us. Not for the purpose of exposing gross misdeeds of warmongers or polluters responsible for countless deaths, but to provide trivial information that is usually smutty or demeaning of powerless people. Large sections of the fourth estate have become the new coliseums publicly torturing the weak to turn our attention away from the real tragedies and crimes of the time.

The worst betrayal is that politicians and political parties for the most part cannot be trusted. They constantly lie to us and withhold information we should know. So long dependent on election handouts from those seeking favours, politicians have forgotten the people they represent. The Howard Government in Australia went to court to uphold the principle that legislation impacting on Aboriginal Australians does not have to be for their best interest.

As has been shown by the invasion of Iraq and Vietnam, lies and propaganda are harming and even killing us. Our leaders invent quasi security threats and exaggerate the errant behaviour of Arab and Asian leaders as reasons for war. The real agenda is to maintain control of oilfields as has happened in Iraq and Libya and now Iran is under threat.

While the reason given for the constant threats and embargos towards Iran is the fear of them developing nuclear weapons there is a corresponding deep silence about the huge nuclear arsenal of Israel. Israel is known for carrying unilateral air attacks on its neighbours with little regard for civilian casualties.

This remarkable and enduring silence is our governments and our media deliberately misleading us because it attempts to hide the true reason Iran is developing nuclear capacity. It is constantly under threat from the US and Israel.

Why is Israel allowed to murder and kidnap scientists political activists and whistle blowers around the globe with little more than a tut tut from the West? Because they help to maintain American hegemony in the oil rich Middle-East. Why are there no inspections of Israeli nuclear facilities? Because the USA will not allow it and Israel has no respect for international law.

Why are these lies necessary? They are not being made for our benefit. Our governments claim they are being truthful and when they are shown to be untrue they is an imply they are made for other important strategic reasons. In fact they are made for cold hard commercial reasons. Pre-war rhetoric implies is that if the West does not control oil supplies we will be over-run by the hordes of heathens, Asians, Arabs and other dangerous species, so life as we know it will be destroyed. Our leaders argue that it is a responsible even a righteous act to help the Arab people by taking control of their oil by force.

In fact they know such a scenario is nonsensical. It would be far cheaper to pay more for oil than to engage in a war except when the sustenance of the US military industrial business model is added to the equation. Therein lays the rub.

While Egyptians clearly realise the danger posed to their democracy by the omnipresent military, many in the West have not woken up to dangers imposed on their democracy by the power held by the US military industry. However, the many thousands of people supporting the Occupy Wall Street Movement have clearly recognised that the greed of their private corporations are devouring the rights and protections of ordinary citizens.

While the corporate press is doing its best to undermine and confuse the purpose of activists by claiming that there is no coherent message from Occupy protesters, the message is simple, straight forward and powerful.

They are telling governments to get back to representing “we the people”, not they the international corporate interests; otherwise we will take back the power entrusted to you as our parliamentary representatives at the next opportunity.

Through all of this turmoil another major turning of history is occurring. The indefatigable and unlimited greed of the 1% is causing a crisis for capitalism that needs to be addressed if the complete collapse is to be avoided.

Capitalism is destroying democracy while greed is destroying capitalism. Underlining this decay is the fact that non-democratic China with a strongly regulated marketplace and regulated currency is outperforming the so called free market. The old story that capitalism underpins democracy and that capitalism does best in democracies is being challenged to the point that ordinary citizens have lost faith in the delivery of either of these edicts.

Two main factors are driving the demise of capitalism. The first is the uneven distribution of wealth which means fewer people can participate in the market beyond the basics of life. This discrepancy is huge in the USA and growing in most Western democracies.

With the diminishing spending capacity of the mass market, suppliers can only increase sales through the growing world population but this growth is mainly in third world countries where consumers have minimal discretionary spending capacity.

The second factor is the finite nature of resources and in particular energy resources. The market philosophy not only requires continuous growth of consumption but also the increased use of resources. Unfortunately for the market philosophy not only are some key resources like liquid hydrocarbons rapidly diminishing but the monetary and energy cost of extraction are increasing.

Continuous growth is not possible once the peak in resource use has been passed. As we approach the point where supply cannot meet demand the rising costs will drive many out of the marketplace. The most damaging commodity price hikes will be in food where much of the world’s food crops are reliant on nitrogen produced from natural gas which will go into decline at the same time population reaches 9 billion. Unless nitrogen can be produced by some other method billions will starve.

Adding to the problem of living with finite resources the whole living system of humans and other species is being destroyed by man’s activities and the cost of this damage has not been accounted for in the past and only marginal costs are being factored in now.

It is obvious to all that while our planet can live without humankind, humankind cannot live without our planet. Yet our industrialists, mining companies and most of our parliamentary representatives deny the obvious truth hoping to drag out a few more years of gross resource use and production of toxic waste. We cannot ignore this destructive greed to continue otherwise it will destroy more than our democratic system it will destroy our lives.

The 99% movement is the beginning of the movement for survival of our species, for our dignity, truth and freedom. This is the most important war ever.

“I was there to take down the names of people who were arrested… As I’m standing there, some African-American woman goes up to a police officer and says, ‘I need to get in. My daughter’s there. I want to know if she’s OK.’ And he said, ‘Move on, lady.’ And they kept pushing with their sticks, pushing back. And she was crying. And all of a sudden, out of nowhere, he throws her to the ground and starts hitting her in the head,” says Smith. “I walk over, and I say, ‘Look, cuff her if she’s done something, but you don’t need to do that.’ And he said, ‘Lady, do you want to get arrested?’ And I said, ‘Do you see my hat? I’m here as a legal observer.’ He said, ‘You want to get arrested?’ And he pushed me up against the wall.”

Retired New York Supreme Court Judge, Karen Smith, who worked as a legal observer Tuesday morning (22/11/11) in New York after the police raided the Occupy Wall Street encampment, as reported by Democracy Now, the US’s largest community media initiative (not for profit and hot linked on our interpretOr blogroll).

Former Seattle Police Chief Norm Stamper on Paramilitary Policing From WTO to Occupy Wall Street.

One only had to watch SBS or ABC news last night (Thurs) to glean further evidence in support of Norm Stamper’s credible and concrete concerns…

…riot police off the leash in the French countryside, ‘paramilitary’ police in Egypt using American made teargas rounds.

Oh…and police across the US going in hard against Occupy. If only it were a ‘bonfire of the vanities’ (Tom Wolfe), with the ‘big? swinging dicks’ of Goldmen Sucks et al being called to account.

As Stamper in interview states…peaceful protest situations should not elicit paramilitary responses.

As flagged by the interpretOr August ’11, Jeff Madrick, Senior Fellow at the Roosevelt Institute and former economic correspondent to the New York Times, has recently published a metaanalysis of the origins, historical contexts and characteristics of financial crises.

Similarities to Eurozone abound, as the following quote reveals:

“Throughout history, financial crises have been generally similar to each other. An asset – land, housing, stocks, bonds and so on – rises in price, financial institutions lend to investors to buy more, and prices are driven to unsustainable levels. When the bubble bursts, investors sell assets to repay their loans, and prices fall further, often in panic.”

(Jeff Madrick, The Age of Greed, Alfred A Knopff, New York 2011)

the interpretOr also reveals that prior to the collapse of Lehman’s in 2008, Wall St had made trillions from trading sub-prime mortgages that were based on a giant ‘Ponzi’ scheme. How this was achieved was attributable to ongoing deregulation of the finance sector, tacitly permitting finance houses such as AIG and Countrywide to trade essentially unsecured mortgages to a rapacious sector – the buy-in, or incentive, was that sub-prime mortgages were subject to very high interest rates – these flimsy, high risk/high yield products were sold in bulk, providing massive, short-term and unsustainable earnings.

The ratings agencies, (see earlier interpretOr posts), S&P, Moody’s and Fitch, rated these bulk packages of very risky, partially unsecured mortgages, without elaborating on their inherent risks, weaknesses and unsustainability. European and other banks around the globe, bought into these toxic tranches and the resultant GFC was and is the outcome.

see also: the interpretOr: ratings agencies are robbing the poor, the sick and the elderly

plus…ratings agency S&P’s $2 trilliOn error and ‘race to the bottom’

Now, we can add to the indictment: Euro crisis, ‘Silvio’ the clown, toxic sovereign debt…debt that was packaged and leveraged by…the same trio of ratings’ agencies. We’re nearly at 2012 and yet these same greedy, moronic, tragically influential ratings’ agencies are still calling the shots.

In late 2010, a Eurobond dealer broke away from the conformist consensus of his peers and spoke out against the ratings agencies (S&P, Moodys’ and Fitch). This lone voice had made it onto the BBC World Service and clearly stated that the ratings that these agencies had given toxic Greek, Spanish, Italian and Irish sovereign debt were incorrect. He called these government bonds as sub-junk trash. He derided the ratings as being as fetid as the subprime ‘miscalculations’ of 2008 and earlier.

Listeners were not told at the time that these same ratings agencies derive their revenue from the commission that they are paid by the merchant banks and governments that are issuing the bonds that they, the ratings’ agencies, rate.

Italian clown and children’s entertainer, ‘Silvio’, was again in the spotlight yesterday. Following on from his recent revival of dadaist piece, ‘Bling, Bling’, he has been presented with the final tab for his notorious ‘wonga-wOnga’ parties and it’s reportedly even larger than his ego.

BBC WorldService carried a report this weekend of a final party tab of US$2,000,000,000,000 – errr, that’s $2 TRILLION.

There’s breaking news of tens of thousands of demonstrators taking to the streets of Rome this Sunday morning:

Deutche Welle : http://www.dw-world.de/dw/article/0,,15513611,00.html

Silvio’s wOnga buddies, an elusive group known as ‘CRAPA’ – covert ratings’ agency party arseholes – were unavailable for comment.

With his orange tan fading to a more golden hue, noted Italian clown and children’s entertainer, ‘Silvio’, was again in the spotlight yesterday.

As the G20 wrapped up in Cannes, ‘Silvio’ entertained onlookers with a rare return to street performance! As delighted fans gathered ‘al fresco’, he relished in reviving his dadaist masterpiece ‘Bling, Bling’. With its’ existential themes and imagery, comparisons have been made with Godot…

A clearly delighted ‘Silvio’ also quoted an extract from ‘Bling’ to the throng of media:

“I’ve dreamed all my life of making these reforms to the economy, but it hasn’t been possible because of the socialists and communists,”

(‘Silvio’ 4 nOv, 2011)

His revival of ‘Bling, Bling’ is proudly sponsored by Goldmen Sucks and the ratings agency Poor Standards.

(more @ earlier post: ratings agencies busted: pOlice have raided S&P and Moody’s Milan offices )

http://vimeo.com/channels/251589

430 videos as of 3 nOv 2011

A place to collect all the films related to the worldwide movement.

99% = majority!!!

Reuters reporting that Goldman Sachs posted Q3 (US) loss of circa US$450…Lloyd Blankcheque will probably still get a gigantic bonus regardless.

From ‘big swinging dick’ to flaccid ****er…

plus see earlier interpretOr piece: called to accOunt? Goldman Sachs CEO Lloyd Blank(cheque)fein hires top defense lawyer

please feel free to click the following for latest Vimeo global shorts on ‘Occupy’ global movement: we the people…

60 videos / 11 subscribers

13th october 2011 the protest spreads to 1238 areas and is growing daily, spreading throughout the continents

Join the World in Peaceful Protest and stand up to corporations and greedy bankers

show support of the People who Occupy Wall Street Together

we are worldwide it is time to change

together we are strong

together we are heard, spread the media, stay strong

watch as the whole World is watching with you

Reuters and other agencies reporting that the ‘Occupy Wall St’ movement, centered in NY over the last few weeks, has now spread to more than a dozen cities across the US – from coast to coast and in between too. Protesters are expressing their dissatisfaction and frustration with the toxic shenanigans of the ‘big (?) swinging dicks’ on Wall St – behaviours past and present a source of outrage….

Dallas Federal Reserve President Richard Fisher surprised a business group in Fort Worth, Texas on Thursday when he said: “I am somewhat sympathetic — that will shock you.”

The interpretOr will look more deeply into these developments and keep you posted.

ps. Praise where praise is due re Wayne Swan’s performance as Treasurer here in Oz and his recent global recognition.

(Reuters – breaking news 30 Sept ’11) – JPMorgan Chase & Co and Bank of America Corp were hit with new lawsuits by investors seeking to recover losses on $4.5 billion of soured mortgage debt, expanding the litigation targeting the two largest U.S. banks.

RBS (Royal Bank of Scotland) was holding £1.1 trillion in sub junk derivatives (see earlier interpretOr posts) in 2008. (Andrew Rawnsley, The End of the Party, Viking Penguin, 2010)

That’s £1,100,000,000,000.00 of other peoples’ money that was not worth ‘jack shit’.

The RBS CEO walked out of the catastrophe a very wealthy and excessively rewarded man.

Immediately following the 2008 collapse, there were suddenly 766 Ferraris listed for sale in London alone.

called to accOunt? Goldman Sachs CEO Lloyd Blank(cheque)fein hires top defense lawyer

Joseph Stiglitz (see recent interpretOr post – “ratings agencies robbing the poor…”), Professor of Economics at Columbia University and Nobel Laureate, said the fiscal stimulus package delivered in Australia (by a Labour Federal government) during the global financial crisis was “among the best designed in the world.”

Better than the orange tan and screeching negativity of Abb on Botty (anag.), says the interpretOr.

the interpretOr has given focus to the ratings agency issue because they have massive influence that impacts directly on any notion or reality of the social good.

The world was turned into an enormous market by the forces of Reagan, Thatcher and their successors, and a continuum was born – Murdoch and other major media players provided a fanfare for the idiotic falsehood of ‘Big government BAD…’free’market GOOD’, and the ratings agencies were pivotal to this new realpolitik and to this day, still wield corrosive power.

Ratings agencies were at the dark heart of the subprime fiasco that resulted in the 2008 collapse of Lehmann Brothers and the subsequent global financial meltdown. Why this should still be a concern to those of us with no particular interest in the minutiae of economics, is that this corrupt, venal complicity (ie. awarding worthless financial products and instruments credit worthiness) has had an enormous impact on the ability of governments around the world to provide for the sick, the poor and the elderly.

Nobel winning economists, Joseph Stiglitz (prof. of Economics @ Columbia University), and Paul Krugman (professor of Economics and International Affairs at the Woodrow Wilson School of Public and International Affairs at Princeton University) have analysed the economic data behind the idea that ‘Big Government’ was responsible for down turns, recessions and associated perceptions that only the Right can lay claim to financial responsibility and concluded independently and unanimously that there is absolutely no data to support these beliefs.

In other words, there is no evidence that economic decline or instability is caused by social welfare. The real villain of the piece is the systematic deregulation of the finance sector and the activities of its ‘big swinging dicks’, namely S&P, Moody’s and Fitch.

(see more perspectives at: www.josephstiglitz.com/ and…http://krugman.blogs.nytimes.com/ )

ps. I remember as a kid in England that the first thing Thatcher did upon becoming Prime Minister was to abolish free school milk. I’m obviously not over that one. Anyway, truth is often stranger than fiction.

Wow, that’s sooo reassuring…perhaps ‘News’ missed the US Senate report cited by the interpretOr…then again, maybe they didn’t…

Is the interpretOr alone in wondering, why the silence in Oz and elsewhere re the ratings agencies’ inherent conflict of interest and their culpability re the sovereign debt crisis engulfing Europe?

This morning’s Wall St Journal (Murdoch owned) had plenty of splashes on impending market losses, and debate over S&P’s downgrading of US credit rating, but not a murmur re the elephant, (by now crapping all over the shop), in the room – they are paid BLOODY ENORMOUS COMMISSIONS BY THE PRODUCERS of THE PRODUCTS THAT THEY RATE!

Mork calling Orson, come in please Orson, Mork calling Orson…?